FAQ having USDA Home loans

A switch factor that can also be disqualify a property out of a good USDA financing try the place. Merely services inside the eligible outlying areas, once the designated of the USDA, are eligible because of it brand of mortgage. On the other hand, the house or property is employed while the borrower’s top quarters, maybe not to own capital, agriculture, commercial, otherwise rental motives. It isn’t just the the type of home that must meet USDA financial criteria, the new borrower also needs to qualify. Eg, the borrower’s income have to fall from inside the USDA’s earnings limits, and the very least credit history regarding 620 is generally called for.

Just what Credit score Required to own USDA Mortgage?

The financing rating to possess USDA mortgage acceptance off approved lenders may vary dependent on and this financial or broker you are speaking-to. More often than not, the minimum credit rating getting USDA financing was 620, however some financial institutions need a great 640 otherwise 660 minimal credit ratings. The fresh new RefiGuide will allow you to see the most recent USDA mortgage conditions to be certain that you’re eligible for this type of outlying financing program.

What’s the USDA Home improvement Mortgage?

The USDA’s Solitary Family relations Houses Resolve Money and you will Has program (Part 504) now offers financial assistance having domestic upgrades. It gives lower-focus, fixed-rates funds and you can provides so you can low-income rural residents to own essential house repairs, home improvements, advancements, and you can adjustment.

Do you know the USDA Design Financing Standards?

A beneficial USDA design loan streamlines your house-strengthening process by the merging that which you around an individual financing. So it no-off, low-focus mortgage is a fantastic selection for lower-to-moderate-earnings people seeking make property inside the a rural urban area. The latest USDA structure-to-long lasting fund is actually a variety of one to-date romantic financial backed by brand new USDA.

USDA-Granted Home loans

The latest USDA including issues home loans directly to individuals with the brand new most useful economic you need and other demands. Thus the family have to meet with the pursuing the requirements:

- You don’t need to a safe, pretty good or sanitary spot to alive

- You can not get a mortgage off a consistent lender

- You really have an adjusted money that’s underneath the lower-income limitation in your area

USDA will offer a primary loan to possess an effective house or apartment with 1800 sq ft otherwise shorter, and with a market value in mortgage restrict with the area. Such numbers can differ based upon the room. loans Pine Apple A beneficial USDA mortgage loan would-be $500,000 or maybe more within the California, so that as lowest as the $100,000 during the elements of the fresh new rural You. The us government even offers USDA- financing financing to qualified consumers and you will qualified services.

Belongings which are not Entitled to USDA Money

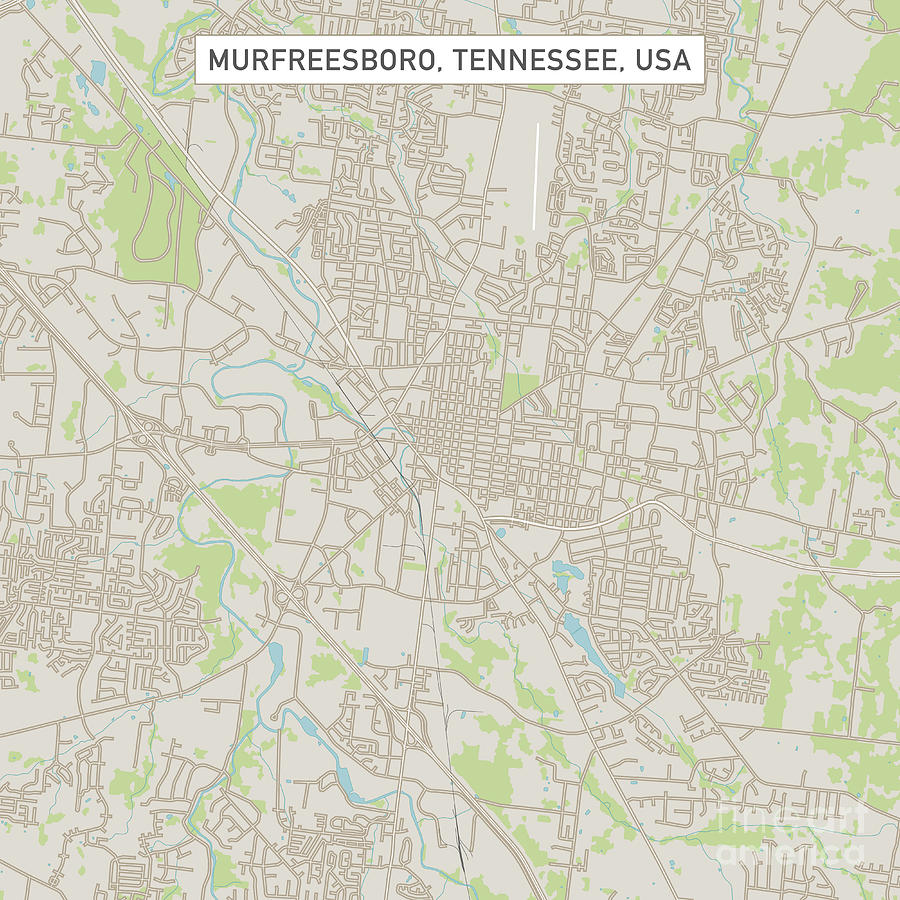

A primary maximum of the program is that most towns do not meet the requirements. Just be based in an outlying urban area. But there are several residential district portion you to too.

Just how to Sign up for USDA Home loan

To try to get USDA financial you ought to keep in touch with a acknowledged USDA rural lending company now. Keep in mind that its not necessary to be hired during the one variety of industry in order to be eligible for an outlying home loan from new USDA. There are even financing to own a primary-date domestic customer that have poor credit, in the event the debtor suits the fresh USDA loan eligibility conditions.

Those with a reduced income and you will a lowered credit score should consider secured finance. You can buy a very low interest rate and you will no off, 100% investment occasionally. Just be sure that you will be considering property that be eligible for an excellent USDA financing system. Consult with your real estate agent and just have your ex partner only show you characteristics that qualify for a good USDA rural financing.