First, the ones you love user or pal is also call their credit card team and have to provide you once the an authorized user on the current bank card.

Of a lot card issuers declaration security passwords towards the three significant borrowing bureaus for primary cardholders and subscribed pages. For individuals who become a 3rd party user into the a well-treated charge card, if in case the membership turns up on your own credit file, the get you are going to gain benefit from the confident background. This new approach will not usually really works, it could be value trying.

Negative levels, for example stuff and you can charges-offs, could potentially harm your credit score. Therefore, in the event your finances lets, spending or paying down negative accounts could be wise.

Although https://paydayloansconnecticut.com/crystal-lake/ not, one which just repay a vintage collection, its useful to know very well what can be expected out-of a credit rating standpoint. There’s two reasons why resolving an outstanding bad equilibrium you are going to not do far for the credit rating.

- Using a terrible account cannot remove it from your credit report. The fresh new FCRA permits the credit revealing companies to go out of really negative account in your credit history for seven ages. (Note: Certain bankruptcies can also be remain on your credit history for as long because ten years.) Repaying or paying off a free account wouldn’t make the credit reporting firms erase it in the course of time.

- Credit scoring habits may still count reduced stuff (and other negative membership) against your. Loan providers have fun with more mature products of your own FICO Rating when you apply having a home loan. Having earlier Fico scores, the existence of the new range membership on your statement is what affects your credit score, maybe not brand new account balance.

However, suppose an awful account try wrong. Therefore, you can conflict it and attempt to get it erased away from your credit score (look for over). Otherwise, you will find several other means you can look at known as shell out-for-deletion strategy.

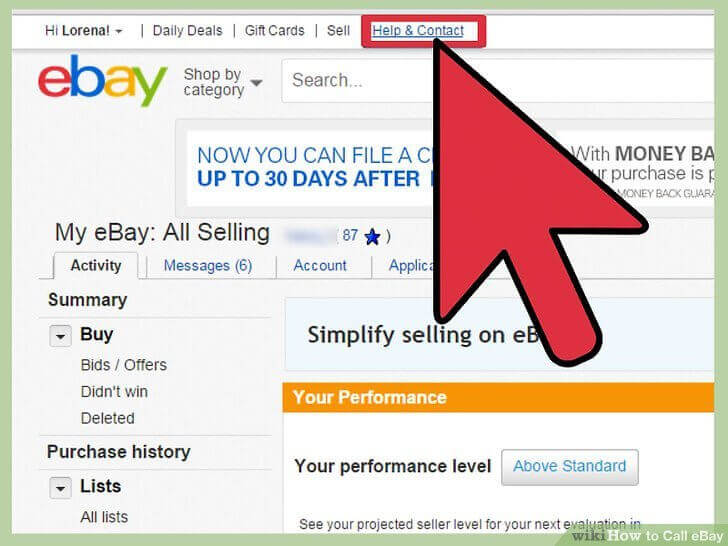

For those who have someone you care about with a decent mastercard account, a simple favor has the potential to improve your credit score

The goal of a portfolio service would be to-your suspected they-assemble outstanding costs. Thus, you’re in a position to convince a financial obligation collector to inquire of the financing bureaus to get rid of a negative account from the borrowing from the bank reports in exchange for percentage. Guess you may be successful and also the membership will come of your credit score. Therefore, it will no further have bad affect their credit score.

Note that the latest fee-for-deletion strategy can be an extended take to. A financial obligation enthusiast may turn down your request. If you learn a debt collector that’s willing to invest in instance an arrangement, make sure you obtain the offer on paper before you can pay.

5. Mix up your own borrowing membership.

Credit rating patterns may reward your for having a healthier blend off membership items on your own credit history. Having Credit ratings, such as, your borrowing from the bank merge makes up 10% of your credit score.

Essentially, we want to possess both revolving and payment membership on your credit reportsmon types of revolving levels were credit cards, family guarantee lines of credit, and you can shop cards. Cost account, meanwhile, can be signature loans, mortgages, auto loans, student education loans, etcetera.

Knowing your missing one of several brand of borrowing from the bank significantly more than, beginning a special membership you are going to benefit you. Instance, you could think trying to get a cards creator membership when your credit history will not inform you any cost credit. Of course, if your credit report has no revolving borrowing from the bank, providing credit cards could well be useful. Just make sure you pick suitable types of mastercard for the condition.

However, before you can unlock people this new account, make sure that you is also commit to paying them timely so they can let, not harm, your credit. In the example of a unique charge card, furthermore necessary to maintain your harmony-to-maximum ratio reduced for similar reason.